Ale's little corner of the internet

Autoscaling and Alaskan Fishing Boats

Nov 26, 2022Read time: 6 min

TL;DR: This article compares two different ways of running companies, autoscaling and alaskan fishing boats, and argues that the second model is ultimately more sustainable and human.

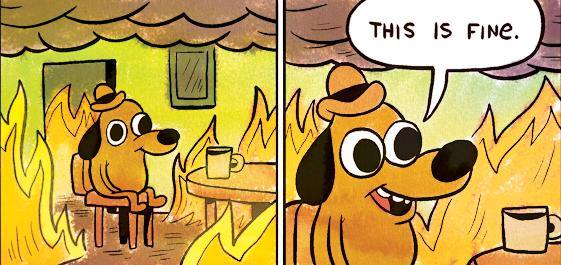

This Is Fine, © by KC Green

During the pandemic, the US government handed out an estimated $817 billion in stimulus checks. It turns out that when people are stuck at home, bored, and with lots of “free money”, they tend to go buy things and services online. When demand is high, prices go up, and companies make more money. Unsurprisingly, tech companies were the ones that benefited the most from this surge in demand. To quote Kia Kokalitcheva from Axios.

The 2020-21 period saw consumers and businesses spending on a variety of goods and services at surprisingly high levels — and fueled startups’ revenues. Many assumed this level of demand was the new normal.

To support this increase in demand (which, remember, was assumed to be “the new normal”), tech companies scrambled to quickly increase their output. When you are scrambling, you often don’t have a lot of time to ponder the consequences of your actions and you are more inclined to do things that don’t necessarily scale. As a result, many tech companies went on a hiring spree, trying to “throw more people” at their sudden growth problem.

However, as the pandemic started to ease its grip, people started stepping out of their homes again. They also started to run out of “free money” and/or started spending on other things (e.g. gym subscriptions, traveling, restaurants, bars, etc.) As a result, consumption of digital goods rapidly shrank and many tech companies started to see their margins plummet, while the specter of a large-scale economic recession started looming on the horizon.

The cost of “Hypergrowth at all costs”

Last week, Christopher Hohn (Managing director of TCI Fund Management Limited) sent a letter to Sundar Pichai (CEO of Google). Hohn writes:

We are writing to express our view that the cost base of Alphabet is too high and that management needs to take aggressive action. The company has too many employees and the cost per employee is too high. Management should publicly disclose an EBIT margin target, substantially reduce losses in Other Bets and increase share buybacks.

Google’s Search business has high operating leverage and is not labour intensive. Despite strong revenue growth, operating leverage has been minimal over the last five years. In Q3 2022, total expenses grew 18% year-over-year while revenues grew only 6%. The EBIT margin of the Google Services segment contracted from 39% in 2021 to 32% in Q3 as a result.

During a period of high growth between 2017 and 2021, revenues increased at an annual rate of 23%, cost discipline was not a priority. However, cost discipline is now required as revenue growth is slowing. Cost growth above revenue growth is a sign of poor financial discipline.

The letter came a few days after Zuck announced it was laying off 13% of Meta (that’s 11,000 people!) and a few days before Amazon announced it was laying off 10,000 of its employees. All of a sudden, what seemed like an unstoppable growth of the tech sector during the pandemic, turned into 130,000 people losing their jobs (not to mention their money with the implosion of the crypto universe, but I’m saving that story for a different article).

What went wrong?

Autoscaling

If you have been around the world of Cloud Computing, you might be familiar with the term Autoscaling.

Autoscaling, […] is a method used in cloud computing that dynamically adjusts the amount of computational resources in a server farm - typically measured by the number of active servers - automatically based on the load on the farm.

This ability to adjust server capacity proportionally with user traffic has been pivotal to enabling tech companies to increase their reliability, performance, and operational efficiency and better serve their customers.

When you spend a lot of your time in the world of bits, the habits, and models you develop there will tend to carry to the world of people (a good example of Availability bias). You might therefore be tempted to apply strategies and mental models developed in the world of bits to the world of atoms and people. Sadly, this often leads to disappointment or making the wrong decisions because humans are not computers.

People are not computers

One perhaps obvious difference between humans and computers is the fact that bits are much easier to move around than atoms. Certainly, they are easier to move around than the roughly 10^27 atoms that make up each one of us. Because of this difference, the behavior of digital systems can be changed quite dramatically in a short time which is not necessarily true for people.

On top of this, because humans are obstinately humans, they have emotions that tend to be influenced by abrupt changes. As you have probably experienced, when someone’s emotional well-being is compromised, their productivity also tends to take a hit.

All of this is to say that layoffs are an extremely abrupt and disruptive change to a company and their use should be evaluated very carefully._ Layoffs should be used as a “last resort” intervention, when nothing else can be done, and not as a tool to “autoscale” your business to adapt it to market demands. Humans don’t autoscale well.

Alaskan Fishing Boats

In this week’s episode of his Unsupervised Learning newsletter (the highest signal-to-noise ratio newsletter out there at the moment, IMHO), Daniel Miessler writes:

What if companies are supposed to be like Alaskan fishing boats? You know, the kind of The Deadliest Catch. So you have this tiny crew of total badasses. Everyone is a superhero at their particular role because the crew needs to stay extremely small to protect profits. The captain is a dictator. The mission is clear. And bad performances from anyone is immediately noticeable and immediately dealt with. You hurt your back? Sorry, you’re a great crew member, but you’re not going out on this trip. You want to spent more time with your brother who’s visiting? Cool, you’re off the ship. This crew is for hardcore people only. Remind you of anything? Reminds me of how Elon runs things at his companies, and now Twitter. Being someone who likes people, and who wants to see them happy and thriving, I’m disgusted by this approach to managing people. But thinking about the actual economics of it, and thinking about what a fishing boat or a social media company is actually there to do, and I’m not sure it’s the wrong approach. In fact, I think it might be the only approach that doesn’t lead to a constant pendulum of hiring thousands of people with multiple levels of management, which creates a structure and culture of mediocrity, who then have to be laid off on every down cycle. So here’s the question: is it possible to run a company like an Alaskan Fishing Boat without being an asshole? To do so with empathy and camaraderie, and kinship? I think so. I think it’s just harder, and that there are multiple forces working against anyone who tries to do so. Not the least of which is the fact that people now join companies thinking they’re getting a second home, not an Alaskan Fishing Boat. I also like this analogy for another reason. It makes it clear that it’s a job and not your identity. You are not a crew member. You are not IBM employee number 3329087. You’re a human. So sure, you can serve on the boat, and be paid, but don’t let that captain tell you your value. Your value is in yourself, not what you do working on a fishing run. I think this way of thinking about work brings clarity to multiple phenomena we’re currently witnessing.

I like this Alaskan Fishing Boats approach to running a business much more than the “autoscaling” model (or its more extreme version: Blitzscaling) which seems to be quite popular among tech companies. Still, the question remains: how do you run a business like an Alaskan Fishing Boat without being an asshole? I’m leaving that for a future post.